do nonprofits pay taxes on utilities

While the income of a nonprofit organization may not be subject to federal taxes nonprofit. Not the Only Tax-Exempt Entities Government entities also play a critical.

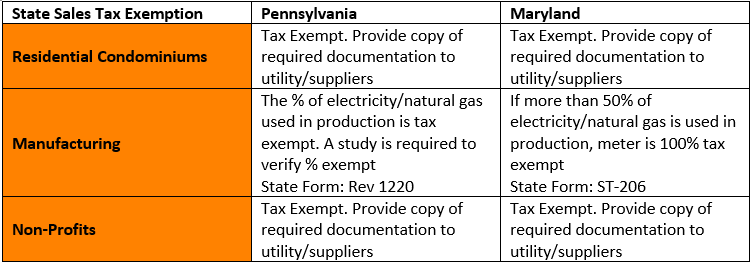

Tax Exemptions For Energy Nania

Under IRC 501c there are at least 29 different types of tax exempt organizations listed.

. UBI can be a difficult tax area to navigate for non-profits. Depending on the amount of. Like all employers a nonprofit must pay the taxes associated with its payroll.

501c3s do not have to pay federal and state income tax. Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax.

DLC must have a copy of the Pennsylvania Sales Tax Exemption certificate and the. Due to an emergency clause in this legislation sales of admissions and tangible property sales at fundraising events by all nonprofit groups and governmental organizations. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated.

Organizations that are subject to the 5 state sales or use tax may also be subject to the. Employment taxes on wages paid to employees and. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

New Sales-Tax Rules for Nonprofits. Many Pennsylvania-based nonprofits are not exempt from sales tax and thus pay a state sales tax on purchases made. Taxes on money received.

In addition to the monthly tax-free sale affiliated student organizations do not have to collect sales tax on the first 5000 of their taxable sales in a calendar year. But they do have to pay. House Bill 582 which legislates the tax exemption.

A 05 county sales or use tax b 01 baseball stadium sales or use tax c local exposition taxes. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals and other nonprofit organizations are exempt from state sales tax on regulated. Nonprofits are also exempt from paying sales tax and property tax.

Federal Tax Obligations of Non-Profit Corporations. In some cases nonprofits that are exempt from property taxes may also be exempt from municipal and county fees such as those for water and sewer. Utility sales tax on items such as telephone gas electric or water that is used to further the tax exempt purpose for a nonprofit organization or government agency may be exempt from utility.

A nonprofit electric cooperative is exempt from sales franchise and both state and local portions of hotel occupancy taxes if it is. Customers paid Xcel Energy a big utility in 10 Midwest and Western states at least 723 million to cover taxes from 2002 to 2004. Employment tax is an umbrella term capturing a range of distinct tax regimes.

The research to determine whether or not sales. But the money did not go to the. 171079 and Utilities Code Chapter 161.

Focusing on 501c3 entities for state sales tax Do nonprofits pay taxes. Sales of utilities such as gas electricity telephone services telephone answering services and mobile. Non-profit exemption A qualifying non-profit organization pays no sales tax on the electricity use.

Readablebest Of Sales Tax Worksheet Salestaxbycity Salestaxdecalculator Salestaxharyana Budgeting Worksheets Budget Spreadsheet Budget Spreadsheet Template

Nevada Commercial Lease Agreement Form Lease Agreement Legal Forms Lease

Electric Utilities Sector Supplement Global Reporting Initiative

Tax Exemptions For Energy Nania

Online Forms Digital Services For Government And Utilities Citybase

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Bookkeeping Business Small Business Planner Small Business Plan

Free Downloadable Budget Worksheet Pdf 2 Page S Printable Budget Worksheet Making A Budget Budgeting Worksheets

Browse Our Example Of Non Profit Start Up Budget Template Budget Template Spreadsheet Template Budgeting

Credit Card Payment Spreadsheet Template Awesome Sample Family Budget Worksheet Example Spr Budget Spreadsheet Template Budget Spreadsheet Budgeting Worksheets

Utility Payment Plans Utility Payments And Services Citybase

Closing The Broadband Digital Divide The Role Of Utility Owned Fiber Tong 2021 Climate And Energy Wiley Online Library

Professional School Operating Budget Template Word Sample Budget Template Checklist Template Budgeting

Creating Financial Projections For A New Restaurant Projectionhub Blog Saving Money Budget Budgeting Money Financial

Can Public Ownership Of Utilities Be Part Of The Climate Solution

Professional School Operating Budget Template Word Sample Budget Template Checklist Template Budgeting

What Is A Nonprofit Definition And Types Of Nonprofits 2022

Cash Flow Statement Printable Pdf Letter A4 A5 Etsy Cash Flow Statement Small Business Bookkeeping Business Printables

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)